Moving to the UK for studies is an exciting adventure, but it comes with financial responsibilities that every student must prepare for. Understanding your monthly expenses in the UK is crucial to manage your budget effectively and avoid unnecessary stress.

Did you know? According to a 2024 survey by the National Union of Students (NUS), over 60% of UK students report financial worries affecting their academic performance. That’s why having a detailed student budget planner and knowing the average monthly expenses UK can make all the difference.

This article breaks down typical monthly living costs, offers budgeting tips, recommends the best bank accounts for students, and introduces tools like the monthly expenses calculator and monthly expenses spreadsheet to help you track your spending smartly in 2025.

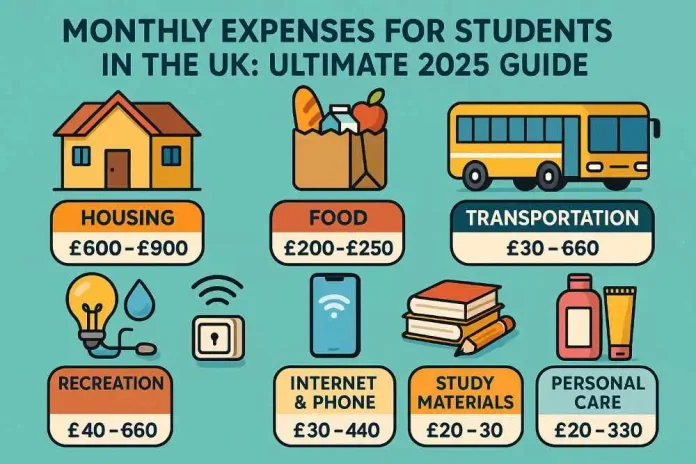

What Are the Typical Monthly Expenses for Students in the UK?

Your monthly expenses list will vary depending on location, lifestyle, and accommodation choice. Here’s a detailed breakdown of the most common costs:

1. Accommodation

- Rent: £400 – £1,200 per month, depending on city and type (university halls, private housing, shared flats).

- Utilities: £40 – £80 (electricity, water, heating, internet).

- Affordable student housing options are available in cities like Liverpool and Sheffield, offering lower rents compared to London or Oxford.

2. Food and Groceries

- Average £150 – £250 monthly. Cooking at home reduces costs significantly.

- Eating out occasionally can cost £10 – £15 per meal.

3. Transportation

- Monthly public transport passes range from £40 (smaller cities) to £120 (London).

- Many universities offer discounted travel cards for students.

4. Study Materials and Supplies

- Budget around £30 – £60 for books, stationery, printing, and software subscriptions.

5. Personal and Leisure Expenses

- Mobile phone plans: £10 – £30 monthly.

- Entertainment, social outings, gym memberships: £50 – £100.

6. Miscellaneous and Unexpected Costs

- Healthcare (NHS charges for some services), laundry, clothing, and emergencies can add £20 – £50 per month.

Average Monthly Expenses in Key UK Student Cities (2025)

| City | Rent (Per Month) | Utilities | Transport | Food & Misc | Total Avg Monthly Cost |

|---|---|---|---|---|---|

| London | £900 – £1,200 | £70 | £120 | £300 | £1,390 – £1,690 |

| Manchester | £500 – £800 | £50 | £60 | £250 | £860 – £1,160 |

| Birmingham | £450 – £750 | £50 | £60 | £240 | £800 – £1,100 |

| Glasgow | £400 – £700 | £45 | £50 | £220 | £715 – £1,015 |

| Liverpool | £350 – £600 | £40 | £40 | £210 | £640 – £890 |

| Oxford | £700 – £1,000 | £60 | £80 | £260 | £1,100 – £1,400 |

How to Use a Monthly Expenses Spreadsheet and Calculator for Students

A monthly expenses spreadsheet is an excellent tool to track all your income and spending. You can customize categories such as rent, utilities, groceries, and transport.

A monthly expenses calculator (available on many budgeting apps) helps you forecast expenses before arrival, ensuring you have sufficient funds and avoid surprises.

Best Bank Accounts for Students in the UK (2025 Update)

Opening a bank account is vital for managing your money abroad. The best bank accounts for students offer benefits like:

- No monthly fees

- Interest on balances

- Overdraft facilities tailored to students

- Easy online/mobile banking

Popular banks among students include HSBC, Barclays, and NatWest. Many offer special student packages and cashback deals.

Budgeting Tips for Students: Managing Your Finances Smartly

- Create a student budget UK: List all expected income (allowances, part-time work, scholarships) and expenditures.

- Prioritize essential expenses: Rent and food come first. Cut back on discretionary spending.

- Use budgeting apps: Tools like YNAB, Mint, or Monzo help track spending in real-time.

- Look for discounts: Many UK retailers and service providers offer student discounts with a valid ID.

How Financial Aid for Students Can Help Reduce Monthly Expenses

If you’re worried about finances, seek financial aid for students through:

- University bursaries and hardship funds

- Government grants for international students

- Scholarships to cover tuition and living costs

Be sure to research eligibility early in your application process.

Conclusion: Plan Your Monthly Expenses for a Stress-Free Student Life in the UK

Understanding and planning your monthly expenses is crucial to enjoy a balanced and successful student life in the UK. Use tools like the student budget planner, open the best bank accounts for students, and keep track with a monthly expenses spreadsheet or calculator.

Being proactive about your finances will help you focus on what truly matters—your education and experiences.

🔖 Bookmark this guide, share it with fellow students, and comment with your budgeting tips or questions!

FAQ

What are the average monthly expenses for students in the UK?

The average monthly expenses in the UK range from £800 to £1,300, covering rent, food, transport, and utilities.

How can I use a monthly expenses spreadsheet to manage my student budget UK?

A monthly expenses spreadsheet helps you track income and spending, categorize bills, and plan your budget effectively.

Which are the best bank accounts for students in the UK?

Top student bank accounts offer no fees, overdraft facilities, and easy mobile banking. Popular options include HSBC, Barclays, and NatWest.

What should be included in a monthly expenses list for students?

Include rent, utilities, groceries, transport, study materials, mobile phone, and personal expenses.

How can a monthly expenses calculator help students?

It estimates your total monthly living expenses to help plan finances and avoid overspending.

What budgeting tips for students can reduce monthly living expenses?

Cook at home, use student discounts, choose affordable student housing, and limit non-essential spending.

Are utilities usually included in student accommodation fees?

Often, utilities are separate from rent, so students should budget for electricity, water, and internet bills.

How does financial aid for students affect monthly expense?

Financial aid can cover tuition or living costs, reducing out-of-pocket monthly expenses.

What is the typical cost of affordable student housing in the UK?

Affordable student housing typically ranges from £350 to £600 per month, depending on the city.

How important is a student budget planner for managing household monthly expense?

A student budget planner is essential to track and control spending, ensuring you stay within your financial limits.